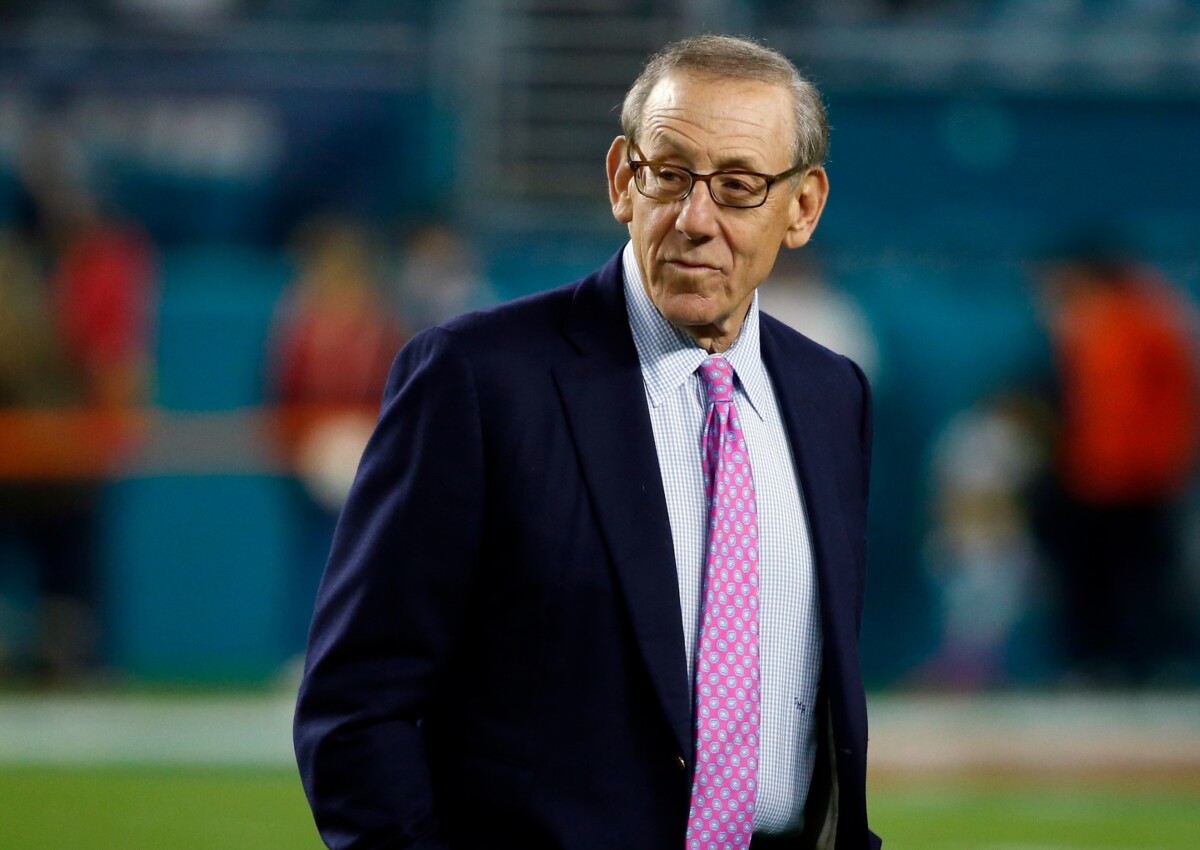

The Fins are about to make a splash in the NFL – not on the field (yet), but in the owner’s box. Miami Dolphins owner Stephen Ross is in advanced talks to sell a limited stake in the franchise, Hard Rock Stadium, and the F1 Miami Grand Prix to private equity firm Ares Management and Joseph Tsai, according to Bloomberg News. This potential blockbuster deal, valued at a whopping $8.1 billion, could see the Dolphins make a major financial leap, becoming the second most valuable NFL franchise behind the Dallas Cowboys.

Deal Breakdown: Who’s Buying In?

According to Bloomberg, Ares Management is poised to acquire a 10% stake in the Dolphins, while Tsai, the co-founder and chairman of the Alibaba Group, would buy a 3% stake through his family office, Blue Pool Capital. Tsai is no stranger to the world of sports ownership, already holding stakes in the Brooklyn Nets, New York Liberty, San Diego Seals, Las Vegas Desert Dogs, and Brooklyn’s Barclays Center. This deal would mark his first foray into the NFL, adding another prestigious franchise to his impressive portfolio.

From Griffin to Ares: A Second Shot at a Partner

This isn’t Ross’s first attempt at bringing in a partner. Earlier this year, he was in talks with Ken Griffin, founder and CEO of Citadel, for a similar deal involving a 10% stake.

However, those discussions fell through in April. Now, it seems Ross has found new partners in Ares and Tsai, potentially paving the way for a major shift in the Dolphins’ ownership structure.

Dolphins’ Value Skyrockets: A Look at the NFL’s Financial Elite

Talk about making waves! This potential deal would put the Dolphins in the same financial league as the Cowboys and Rams. Here’s where they’d stand in the NFL’s hierarchy of value:

- Dallas Cowboys: $11 billion

- Miami Dolphins (projected): $8.1 billion

- Los Angeles Rams: $8 billion

- New England Patriots: $7.9 billion

- New York Giants: $7.85 billion

- Las Vegas Raiders: $7.8 billion

The NFL’s Changing Landscape: Private Equity Enters the Game

This potential deal with Ares and Tsai is a significant moment for the NFL. It would be the league’s first private equity transaction, reflecting a broader trend of institutional investors seeking a piece of the lucrative sports pie. The NFL recently changed its ownership rules to allow for such investments, aiming to attract billions in capital and further boost team valuations.

What’s Next: The Road to Approval

Ross is expected to seek NFL owners’ approval for the deal at a December meeting. If approved, the new ownership structure could have a significant impact on the Dolphins’ future. With a potential influx of capital, the team could have more resources to attract top talent, improve their facilities, and build a championship contender.

From Super Bowl Dreams to a Rocky Start: Can the Fins Turn It Around?

Before the season started, Ross confidently declared the Dolphins as Super Bowl contenders if they stayed healthy. However, the team’s current 1-3 record paints a different picture.

Quarterback Tua Tagovailoa suffered a concussion in Week 2, and edge rusher Jaelan Phillips is out for the season with a knee injury. While the Dolphins have faced their share of challenges, this injection of capital could be just what they need to build a championship contender.

“We are certainly a contender for the Super Bowl if we stay healthy.”